Chargebee Vs. Upscribe: The Perfect Ecommerce Subscription Alternative

Chargebee is a powerful platform to manage and grow your subscription offerings. That said, it may not have the right features depending on your needs.

In this guide, we’ll go through Chargebee’s various features and pricing, then explain how Upscribe may be a better alternative if you’re running a Shopify store. Let’s begin.

What is Chargebee?

Founded in 2009, Chargebee is a subscription billing and revenue management system. With a G2 score of 94 from more than 500 reviews, thousands of businesses across a wide range of industries use this service to grow their subscription offerings. Some of Chargebee’s key clients include:

Chargebee’s key features

Chargebee provides a powerful platform to help businesses manage their product subscriptions and structure their recurring payments system. Because it caters to a variety of niches, its complexity can be a double-edged sword.

While Chargebee provides an all-in-one solution for your subscriptions, businesses with more specific needs may find other alternatives much easier and more effective to use to meet their goals. For instance, if you’re running a Shopify store, Upscribe has a simpler interface that allows you to quickly manage your subscriptions and get actionable insights from key subscription-based analytics. To put it simply, Upscribe makes it easier to deliver a powerful customer experience to your subscribers.

Let’s go through its key features.

Subscription lifecycle management

This is a suite of features that allows you to automate the essential yet boring parts of the customer lifecycle. It also helps you grow your average subscription value in the process by helping you meet customer expectations at every stage of the life cycle. These include:

- Nudging trial users to the paid plan.

- Collecting payment information.

- Up/downgrading billing plans.

- Subscription renewals.

Seamless checkout experience

Chargebee aims to provide a secure and frictionless checkout experience. Features that help facilitate the process include:

- Guest checkouts and free trials: Customers can purchase products or try out your services without them having to sign up.

- Checkout analytics: Track checkout abandonments and trigger emails to see why customers have decided against making the purchase.

- Options to buy once or subscribe: Chargebee allows customers to either buy once or register for a subscription.

Diverse payment methods. You can scale internationally with diverse payment options for more than one hundred currencies. Popular Chargebee payment gateways include Stripe, GoCardless, BlueSnap, and Checkout.com.

Advanced invoices

In its more expensive packages, Chargebee offers invoicing features to automatically send branded invoices and provide notes on how the payment should be made. You can also apply credits, send reminders, create credit notes, apply excess payment, remove payments, record refunds, or void invoices.

Italian cloud-based phone system provider Voxloud uses Chargebee’s invoice features to ensure that their B2B electronic invoicing complies with EU-VAT and GDPR.

Plan and pricing management

With Chargebee, users can offer different types of subscription models, including a flat fee, pay-as-you-go, or a fully customized pricing structure. Here are some of the ways you can structure your subscription model:

- Charge customers based on their usage (e.g., bill your customers based on the number of licenses they use, if applicable). This includes usage-based charges made at the end of a given billing cycle.

- Hybrid pricing model that combines usage-based and flat fee pricing.

- Upsell with the use of recurring and non-recurring add-ons.

- Taxation settings (e.g. whether an item/plan should include tax or not).

Flexible pricing bundles to grow your business.

You can also set up flexible billing. These include:

- Grandfathering support: Keep the pricing for old customers to your store even when you change your pricing plans for new ones.

- Managing trials effectively: You can start trials either with or without customer payment info. You can also send enticing emails to turn trial users into paid subscribers.

Dunning management

When customers don’t pay, your online store suffers. Late and unpaid invoices have become more prevalent issues in recent years. In fact, according to PYMNTS, late payment occurs for nearly half of US business invoices.

Thankfully, Chargebee can take care of your dunning concerns. Here are some ways Chargebee’s dunning management achieves this:

- Decouples failed payment retires and email notifications.

- Uses intelligent payment retries. This also works to lower your gateway risks by maximizing recovery and optimizing attempted payment retries.

- Creates dunning summary reports.

- Lets you select dunning rules that sync with your billing logic.

Chargeback management

Chargebee’s automated workflows let you decide how to handle disputes. Chargeback management can minimize future disputes, provide an exceptional CX, and accurately track account receivables.

Chargebee’s chargeback management can:

- Automate chargeback bookkeeping.

- Keep gateway risks to a minimum.

- Let you take timely steps to determine why a customer has made a dispute.

Chargeback management can help you recover revenue that would otherwise have been lost. For instance, one US bank saw $9 million worth of fraud recovered using a chargeback alerts service.

Pricing

You can choose from four payment plans, based on your revenue.

- The Launch package is Chargebee’s free plan. You can use this option for your first $100K in revenue. The plan allows for up to three users and comes with several basic features (e.g., secure checkout and A/R aging reports).

- The Rise plan costs $249 per month. This is for businesses that have around $600k in annual revenue, and it’s available for up to ten users. The Rise version of Chargebee adds features like custom domain, advanced analytics, and CRM integration.

- Next, we have the most popular Chargebee package, the Scale plan. This version costs $549 per month. You can use this edition for your first $1.2M of annual revenue. Up to 25 people may use a Scale plan. It offers additional features like user role management, multiple payment methods, and advanced invoices.

Lastly, there’s Chargebee’s Enterprise package. To use this edition, you’ll need to contact Chargebee’s sales team to request a quote. The Enterprise plan introduces several more features (e.g., contract terms and account hierarchy).

Pros and cons

Pros

- Various payment plans with differing features.

- The more expensive Chargebee plans offer advanced features (e.g., smart dunning, advanced invoices, and priority phone support). Upscribe offers these out of the box.

- A wide range of payment methods for your customers.

Cons

- Its most-used plan is expensive.

- Can be unintuitive due to its wide range of features and large customer base.

- Not specific to ecommerce.

- Many of its plans may offer far more than you need.

What is Upscribe?

With over $500 million processed in subscription revenue, Upscribe is a powerful subscription platform for Shopify stores. With Upscribe, you can:

- Manage and scale your product subscriptions with tools that allow customers to easily purchase and renew subscriptions via email or SMS. Upscribe also offers passwordless login for a more seamless buying experience.

- Reduce overall subscription churn through smart cancel flows and dunning.

Analyze powerful subscription metrics in an intuitive dashboard to increase your subscription revenue, reduce churn, and improve customer loyalty.

As a Chargebee alternative, Upscribe offers many customer experience features and growth tools that are more catered for online stores. Our platform is easier to navigate and provides more meaningful insights to help you grow your product subscription business.

Important: Upscribe enjoys Shopify’s invoicing features as part of its app marketplace ecosystem.

Upscribe’s top features

Subscription lifecycle management

Upscribe offers essential tools to start, manage and scale your product subscriptions at every stage of the customer lifecycle:

- After integrating with Shopify, you can quickly create your subscription plans, including the products that you want in the bundle, the prices, and the billing cycle.

- For one-time purchases, automatically nudge customers with the option to reorder the items they’ve purchased.

- You can use the merchant portal to view all your active product subscriptions and important customer information at a glance. Using the portal, you can quickly provide customer support, as you grow your subscriptions. For instance, after increasing their shipping volume, Caldera Labs used Upscribe to manage their significant growth and effectively provide support without having to hire additional staff. Chargebee doesn’t offer any tools to help customer support for product subscriptions.

- The platform also provides features to devise cancellation flows and dynamic discounts to reduce churn. More on this later.

- It also automatically manages and shows whenever a product is out-of-stock, which can help reduce customer enquiries on its availability.

Reduce churn, increase retention and grow subscription revenue

With a focus on optimizing the product subscription process for Shopify stores, Upscribe has intuitive features to easily overall improve your average customer lifetime value.

Unlike Chargebee, the platform is very easy to use out-of-the-box, as we specifically cater to online stores. Let’s go through some of these features.

SMS & email subscription communications

With Upscribe, you can meet customers where they are and help them manage their subscriptions by themselves. A customer may manage their subscription by SMS or email (i.e., no need for them to log in to a customer portal). This can give your store a bigger appeal to more customers and help them remain subscribed.

Passwordless login

Many of us find it hard to recall our countless online passwords. On average, nearly four in five people forget at least one password every three months.

With Upscribe, your subscribers can benefit from passwordless login. Instead of typing in their passwords, they can log-in through a link sent via email. This reduces subscriber friction and makes their overall experience more pleasant.

Passwordless login can also increase the security of your online store by lowering the risk of your customers being targeted by phishing.

The passwordless authentication market is around $16 billion, but Statista believes this figure will double around 2027 and surpass $50 billion in 2030. It’s clearly a good time to get in on the action.

Cohort actions to increase loyalty

If your subscribers usually drop off after several shipments, Upscribe’s cohort actions could help you devise ways to fix drop-off points by offering smart discounts or free gifts on future shipments.

These actions can make your subscribers more likely to stick around, thereby bringing your Shopify store a higher customer LTV.

Churn deflection

Upscribe provides smart cancellation flows to deflect churn. You can use the platform to provide smart offers (e.g., discounts, product swap, gifting a subscription, etc) that get triggered whenever someone is about to cancel their subscription.

Payment retry

Like Chargebee’s dunning management, Upscribe includes a payment retry feature. Our dunning engine can identify the ideal time to recover declined charges. This feature even limits sending unnecessary SMS or emails to subscribers. The goal of this feature is to maximize your revenue without pushing customers away.

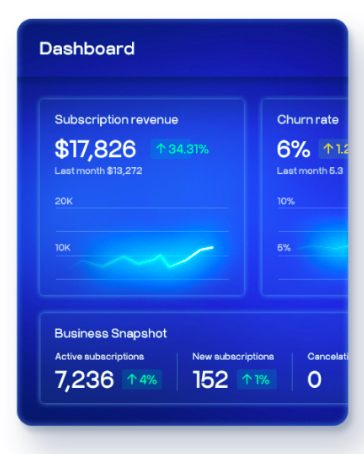

Powerful analytics in an intuitive dashboard

Upscribe offers intuitive dashboards that allow you to:

- Track key product subscription metrics, including subscription revenue, active subscriptions, new subscriptions, cancellations, and churn rate.

- Understand the overall status of your product subscription business

- Identify and devise ways to reduce voluntary and involuntary churn

- Find ways to increase your customer lifetime value, average order value, retention, and overall revenue

For instance, Four Sigmatic grew their active subscription by 50% after switching to Upscribe and actioning insights from our intuitive subscription analytics.

Chargebee vs. Upscribe: feature comparison

Reasons why people choose Upscribe over the competition

We’ve presented our case for choosing Upscribe, but do our customers have to say? Here are some of our customer success stories.

Ready, Set, Food!

Ready, Set, Food! offers a strategy to easily and safely introduce babies to various allergens. This happy customer of ours increased their margins by 25-35% for each order with Upscribe. They took steps like speeding up the loading times of their web pages and resolving many checkout issues. Upscribe also enabled this food brand to handle customer service requests faster.

Four Sigmatic

This food and drinks business sells elevated essentials such as crash-free coffee and plant protein. With Upscribe, Four Sigmatic increased their active subscribers by 50% by lowering customer churn and executing on various retention tactics.

Caldera + Lab

This provider of high-performance men’s skincare used Upscribe to cut their subscription help tickets in half without having to hire additional staff as they significantly increased their shipping volume.

Running a Shopify store? Switch to Upscribe.

In this direct comparison article, we’ve explored the subscription and billing services Chargebee and Upscribe. Each offers various features that can help online stores move to the next level. However, Upscribe is more tailored for Shopify merchants.

Chargebee’s Enterprise edition may interest you if you want something more comprehensive. But, for most online stores, Upscribe is arguably the more suitable option. We’ve kept our pricing affordable and offer exactly what most online stores need to move forward.

Schedule a free demo with Upscribe today and determine whether our service is right for you. If you’d like to learn more about launching and running a subscription-based business, have a read of our blog. We explore topics like Shopify recurring payments and the pros and cons of annual subscriptions.